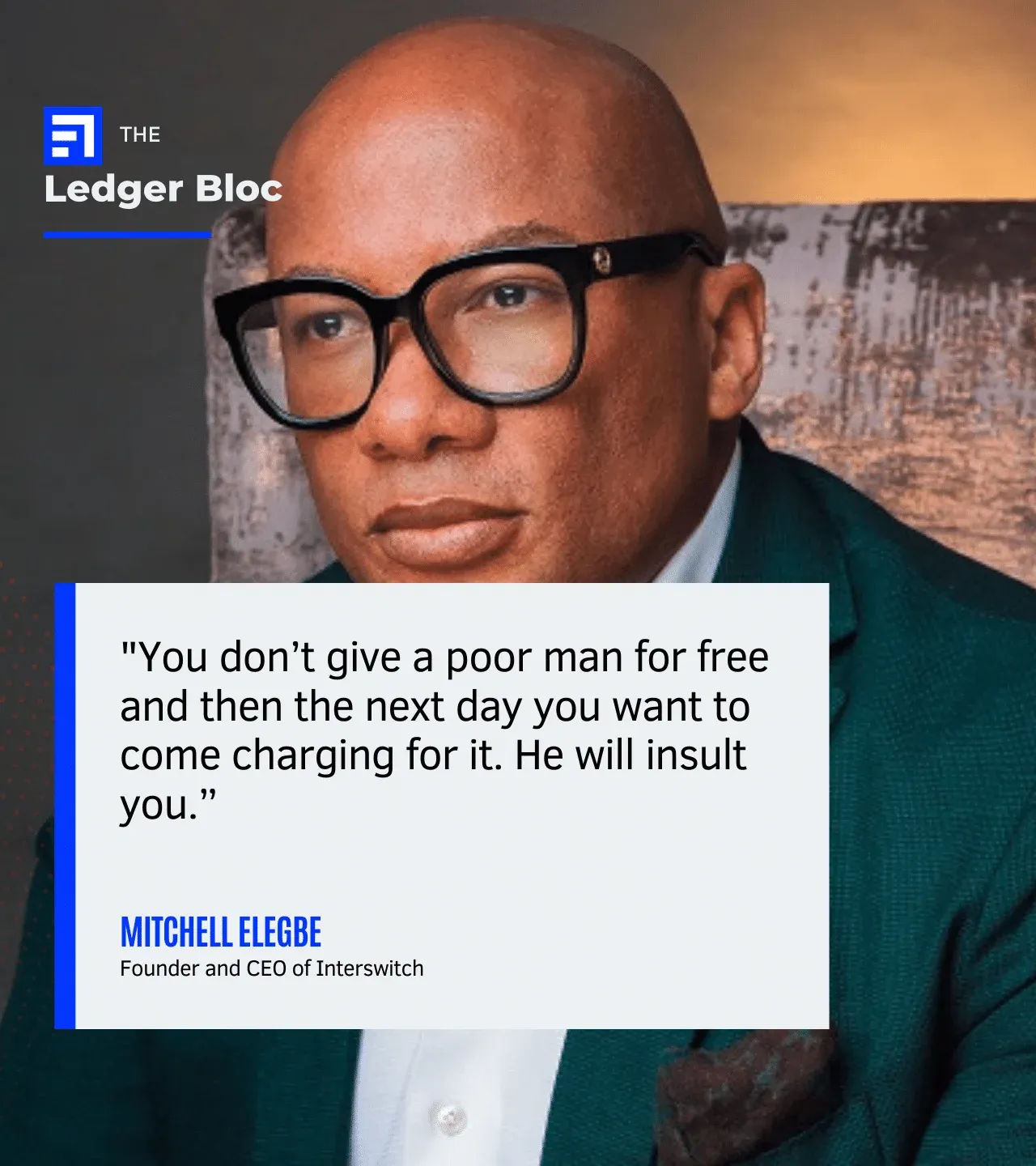

During the 4th edition of the Doing Business in Nigeria Conference (DNBC) in Lagos, Mr. Mitchell Elegbe, the founder and Group CEO of Interswitch, highlighted that numerous fintech ventures in Nigeria might struggle to attain profitability due to their initial reliance on free services. Elegbe emphasized that offering free services to secure market share could hinder monetization prospects for many fintechs in the long run.

The major objective of a business is to make profit. Hence, achieving profitability should be your primary goal, which entails establishing solid unit economics right from the start. It's crucial to focus on sustainable growth rather than chasing grandiose expansion plans without ensuring profitability.

While formal education, including MBAs, provides valuable knowledge, it often falls short in preparing entrepreneurs for the real-world challenges they'll face, particularly in unique local contexts like Nigeria.

Reflecting on his own experiences, Elegbe emphasized the importance of understanding the local business landscape and navigating challenges specific to the Nigerian market. He recounted how, despite global skepticism towards investing in Nigeria, he foresaw the challenges ahead and the limited availability of external funding. This foresight led him to prioritize sustainable growth over reliance on continuous fundraising rounds, a strategy more commonly successful in Silicon Valley but less viable in Nigeria's economic environment.

Elegbe cautioned against the misconception of unlimited fundraising opportunities, urging entrepreneurs to make prudent use of the capital they secure. In the context of Nigeria's business ecosystem, where funding may be scarce, each investment round should be viewed as potentially the last for several years. Therefore, strategic financial management becomes imperative to maximize the impact of available capital and ensure long-term viability.